Diversified platform of mining specific strategies

Disclaimer

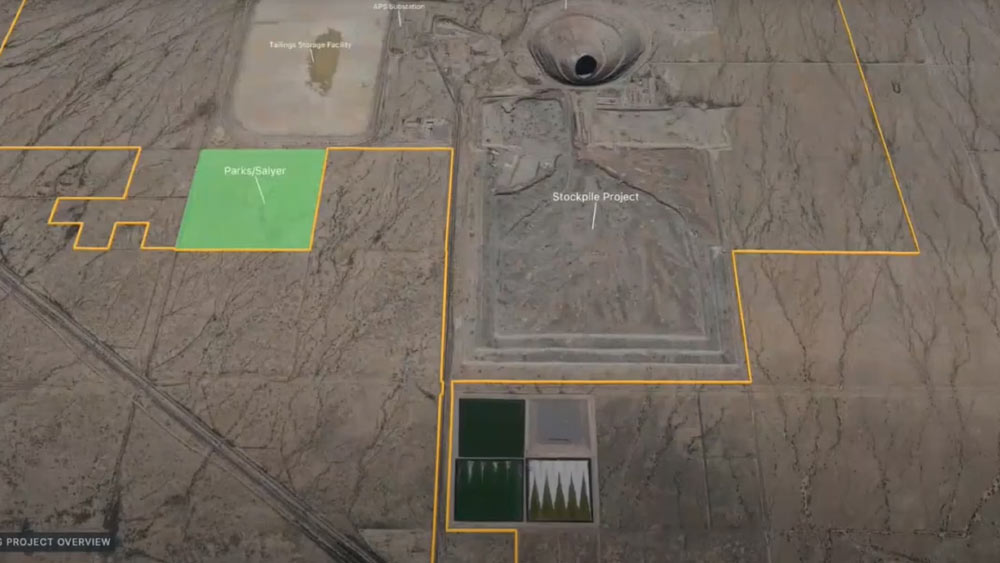

*The video is part of a group of case studies created to illustrate our investment process. It is presented here to illustrate several tools used in the scoping phase. Past performance is not indicative of future results. There can be no assurance that operations or processes described in the video will continue, and such processes may change, even materially. The actual investment process for any or all of RCF’s investments may differ materially from the process described in the video.

Certain information contained herein relating to any goals, targets, intentions, or expectations with respect to Environmental, Social and Governance (“ESG”) considerations is subject to change, and no assurance can be given that such goals, targets, intentions, or expectations will be met. There can be no assurance that RCF’s ESG policies and procedures as described herein will continue; such policies and procedures could change, even materially, or may not be applied to a particular investment. RCF is permitted to determine in its discretion that it is not feasible or practical to implement or complete certain of its ESG initiatives, policies, and procedures based on cost, timing, or other considerations.

Statements about ESG initiatives or practices related to portfolio companies do not apply in every instance and depend on factors including, but not limited to, the relevance or implementation status of an ESG initiative to or within the portfolio company; the nature and/or extent of investment in, ownership of or, control or influence exercised by RCF with respect to the portfolio company; and other factors as determined by investment teams, corporate groups, asset management teams, portfolio operations teams, companies, investments, and/or businesses on a case-by-case basis. ESG factors are only some of the many factors RCF considers in making an investment, and there is no guarantee that RCF will make investments in companies that create positive ESG impact or that consideration of ESG factors will enhance long term value and financial returns for limited partners.

To the extent RCF engages with portfolio companies on ESG-related practices and potential enhancements thereto, there is no guarantee that such engagements will improve the financial or ESG performance of the investment. In addition, the act of selecting and evaluating material ESG factors is subjective by nature, and there is no guarantee that the criteria utilized or judgment exercised by RCF will reflect the beliefs or values, internal policies or preferred practices of investors, other asset managers or with market trends.

RCF Innovation I is not a legally established partnership and represents an extracted portfolio of investments of Resource Capital Fund VI L.P. (“RCF VI”) that was managed by the principals of Jolimont Global Mining Systems Pty Ltd before it was acquired by RCFM in September 2019. Two of the three principals currently manage RCF Jolimont Mining Innovation Fund II L.P. (“RCF Innovation II”) in a substantially similar manner to RCF Innovation I. Total portfolio performance results for RCF VI are available upon request.

Important Information

This material is provided for educational purposes only and should not be construed as research. The information presented is not a complete analysis of the mining landscape.

The opinions expressed may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources deemed by Resource Capital Funds and/or its affiliates (together, “RCF”) to be reliable. No representation is made that this information is accurate or complete. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

None of the information constitutes a recommendation by RCF, or an offer to sell, or a solicitation of any offer to buy or sell any securities, product or service. The information is not intended to provide investment advice. RCF does not guarantee the suitability or potential value of any particular investment. The information contained herein may not be relied upon by you in evaluating the merits of any investment.

Investing involves risk, including possible loss of principal.